Hybrid Multi-Cloud

This article is part of a series. I would recommend reading the articles in order, starting with “Modern IT Ecosystem”, which provides the required framing.

As a brief reminder, this series aims to explore the “art of the possible” if an enterprise business could hypothetically rebuild IT from the ground up, creating a modern IT ecosystem.

This article will focus on my proposed cloud architecture, highlighting my philosophy, key technology decisions and positioning.

Public Cloud

Over the past ten years, the Public Cloud market has seen massive growth. I wrote a short article in 2013, highlighting the dominance of Amazon Web Services (AWS). At the time, AWS was a clear leader, however, the market has matured, resulting in three key players: Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP).

As to which Public Cloud provider is “best” depends on multiple factors, specifically, business requirements, user-base, budget, existing investments and supporting architecture. To simplify the landscape, I often use the LEGO Group as a way of describing the differences between the providers.

-

LEGO = AWS: Like LEGO, AWS is the most popular, with the largest eco-system, highest-rate of innovation and customer engagement. AWS is incredibly versatile, with thousands of services that can be connected to create/support a wide range of solutions. Similar to LEGO, AWS has a strong focus on the eco-system (via its API-Centric strategy), therefore, services tend to target technology-centric customers with software engineering expertise.

-

DUPLO = Azure: Building on their history as an enterprise-focused company, Microsoft often complement their services with enterprise-specific features. Like DUPLO, the “building blocks” tend to be “larger” and therefore, easier to consume for business-centric customers with limited software engineering expertise. Finally, similar to the connection between DUPLO and LEGO, Azure services are often tightly integrated into the wider Microsoft eco-system (e.g. Office 365).

-

LEGO Technic = GCP: Google is very much about engineering excellence, with a strong emphasis on custom/proprietary compute, storage and networking architecture (e.g. TPU). Similar to LEGO Technic, Google is often the first to pioneer new/innovative services (e.g. Kubernetes), allowing for the creation of more “exotic” solutions. In regards to market share, Google is in third place, resulting in a more tightly defined eco-system, which attracts customers with a strong appreciation for engineering excellence.

This analogy is far from perfect and is not designed to articulate the value of each provider. It does, however, recognise the different philosophy, target audience and market size, highlighting that a one-to-one comparison does not tell the full story.

Cloud Strategy

As part of my previously described IT principles and IT declarations, I have positioned a clear direction regarding a “Cloud First” strategy, prioritising Public Cloud for applications and data, with a focus on Cloud Native architecture.

The words “Cloud First”, not “Cloud Only”, are important, as they start to promote the idea of a hybrid architecture, with clear prioritisation. Acknowledging the previously defined business characteristics, I specified an established traditional business model, likely resulting in workloads that would not be commercially or architecturally a good fit for Public Cloud. As a result, as part of my modern IT ecosystem, I have positioned multiple highly-converged Colocation Data Centres, alongside Edge Computing at specific sites (primarily R&D and Manufacturing).

Regarding the Public Cloud itself, I anticipate the need for workloads to run across multiple clouds, unlocking innovation and ensuring healthy cost competition. With this in mind, my proposed cloud strategy would be considered “Hybrid Multi-Cloud”.

To facilitate this outcome, I would position a Cloud agnostic, decoupled, automation layer, supported by techniques and technologies such as Software Defined, Infrastructure-as-Code and Immutable Infrastructure, etc. Due to the importance of this area, I plan to describe my proposed automation architecture in a future article.

The philosophy behind “Multi-Cloud” is certainly compelling, however, as with any commercial investment, the value of standardisation should not be underestimated. As a result, I would position Microsoft Azure as my preferred Public Cloud provider. The following two factors have driven this decision:

-

Although this series assumes no legacy from a technology standpoint, all businesses have a human legacy, with many users (and partners) having a long history consuming Microsoft productivity and collaboration services. Therefore, positioning Microsoft Office 365 would be a logical decision to ensure business continuity and to help reduce the organisation change impact. The use of Office 365 opens the door to a wider commercial deal with Microsoft, allowing the business to maximise the investment across productivity, collaborations and cloud.

-

With the previously defined business characteristics in mind, I highlighted an established traditional business model and growing digital business model. Therefore, I would aim to capitalise on a business-centric skill-set. For example, businesses operating a traditional business model commonly lack Solution Architect and Software Developer expertise, becoming dependant on service integrators for solution delivery. As outlined above, I believe Azure is best positioned for business-centric customers with emerging software engineering expertise.

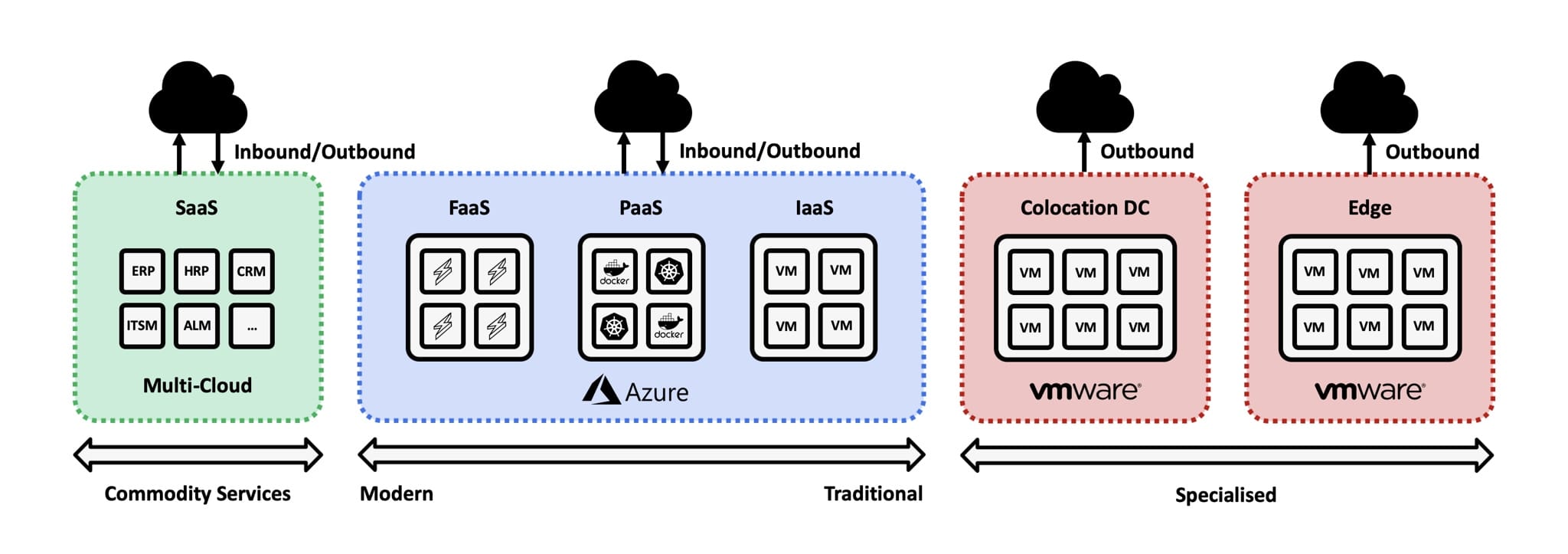

With this positioning in mind, the diagram below highlights my proposed application/data hosting strategy, covering SaaS, Public Cloud, Colocation Data Centres and Edge Computing.

Highly-industrialised/commodity workloads would be positioned for SaaS. Examples would include Productivity, Collaboration, Service Management, Customer Relationship Management (CRM), etc.

Public Cloud would be prioritised for all application/data hosting, emphasising “up the stack” services. For example, FaaS and PaaS would be prioritised over IaaS.

I would position Equinix as my Colocation Data Centre host, providing support for workloads that would not be commercially or architecturally a good fit for Public Cloud. For example, specialised capabilities from R&D and Manufacturing, which commonly require proprietary software/hardware. As highlighted in the article “Modern IT Ecosystem, the proposed Colocation Data Centre architecture would be highly-converged, where I would position Dell EMC PowerEdge MX modular servers running VMware Software-Defined Data Centre (SDDC) technologies. This combination would help to maximise the investment (both part of Dell Technologies), as well as provide flexibility to scale compute, storage and network independently.

Edge Computing would support latency-sensitive applications, predominantly at R&D and Manufacturing sites. Where possible, these sites would complement the proposed Colocation Data Centre architecture, leveraging Dell servers (potentially hyper-converged) and VMware SDDC technologies.

Conclusion

In conclusion, I believe my proposed Hybrid Multi-Cloud strategy would provide a strong foundation for an enterprise business, emphasising modern architecture, whilst being pragmatic, providing options for almost any workload.

This balance would provide ultimate business flexibility, whilst continuing to promote modern application architecture, which could be further incentivised via a streamlined governance and custom charge-back model.